Essential Forex Trading Tips for Beginners 1597957875

Essential Forex Trading Tips for Beginners

If you're new to the world of Forex trading, the landscape can feel overwhelming. However, with the right strategies and knowledge, you can navigate this market successfully. In this article, we'll explore essential Forex trading tips for beginners, discussing everything from fundamental concepts to advanced techniques. To get started, you may want to check out resources like forex trading tips for beginners Latam Web Trading for further insights and tools.

Understanding Forex: The Basics

Forex, or foreign exchange, is the largest financial market in the world, where currencies are traded against each other. The goal of Forex trading is to profit from changes in exchange rates. It is essential to understand some basic concepts before diving into trading.

- Currency Pairs: In Forex, currencies are quoted in pairs, such as EUR/USD or GBP/JPY. The first currency (the base currency) is compared to the second (the quote currency).

- Pips: A pip is the smallest price movement in a currency pair. Most currency pairs are quoted to four decimal places, meaning a change from 1.3050 to 1.3051 represents a movement of one pip.

- Leverage: Forex trading allows for the use of leverage, enabling traders to control larger positions with a smaller amount of capital. While leverage can amplify profits, it also increases risk.

Setting Goals and a Trading Plan

One of the most critical steps for beginners is establishing clear goals and creating a trading plan. Here are a few tips for setting your goals:

- Define Your Objectives: Determine what you want to achieve with Forex trading. Are you looking for supplemental income, or do you aspire to become a full-time trader?

- Assess Your Risk Tolerance: Understand how much risk you are willing to take. Forex trading can be volatile, and assessing your comfort level with risk is crucial.

- Create a Trading Routine: Develop a consistent routine for analyzing the market and executing trades. Stick to your schedule to cultivate disciplined trading behavior.

Education and Research

Continuous education is fundamental to becoming a successful Forex trader. Here are some ways to enhance your trading knowledge:

- Online Courses: Many platforms offer courses that cover various aspects of Forex trading, from basics to advanced strategies.

- Reading Books: Numerous books delve into Forex trading strategies, technical analysis, and market psychology—providing deep insights into trading.

- Joining Forums or Communities: Engaging with other traders through forums can provide practical advice and support. Sharing experiences can help you learn from others’ successes and mistakes.

Technical Analysis vs. Fundamental Analysis

Understanding the different forms of analysis is essential for making informed trading decisions. Beginners should familiarize themselves with:

- Technical Analysis: This approach relies on charts and indicators to identify patterns and predict future price movements. Common tools used in technical analysis include moving averages, Relative Strength Index (RSI), and Fibonacci retracements.

- Fundamental Analysis: This method involves analyzing economic news, reports, and indicators that can affect currency values. Key indicators include GDP, employment rates, and inflation statistics.

Risk Management Strategies

Effective risk management is critical for longevity in Forex trading. Here are some fundamental strategies:

- Use Stop-Loss Orders: A stop-loss order helps limit your losses by automatically closing a trade when it reaches a specified price.

- Position Sizing: Determine how much of your total capital you are willing to risk on each trade and adjust your position size accordingly.

- Diversification: Don’t put all your capital in one currency pair. Diversifying your trades across multiple pairs can reduce risk.

Practicing with a Demo Account

Before risking real money, consider practicing with a demo account. Most brokers offer this feature, allowing you to trade in a simulated environment without any financial risks. This practice will help you:

- Test your strategies in real market conditions.

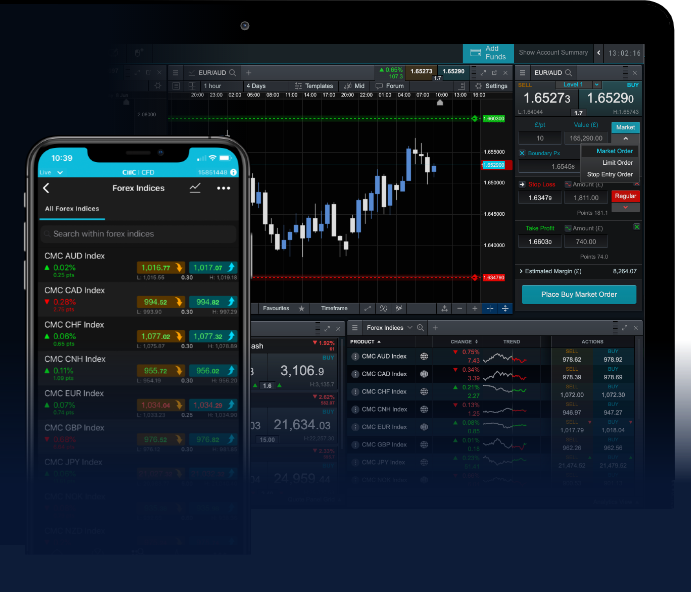

- Become familiar with the trading platform.

- Build confidence in your decision-making processes.

Keeping Emotions in Check

Emotional management is essential in trading. Fear and greed can drive poor decisions and lead to significant losses. Here are some tips to maintain emotional control:

- Stick to Your Plan: Adhere to your trading plan and avoid making impulsive decisions based on emotions.

- Take Breaks: If you find yourself feeling overwhelmed or frustrated, take a break from trading to regroup.

- Practice Mindfulness: Techniques like meditation and breathing exercises can help clear your mind and reduce stress.

Conclusion

Forex trading requires dedication, education, and practice. By following these essential tips, beginners can build a strong foundation for a successful trading journey. Remember to keep learning and evolving your strategies as you gain experience in the market. With patience and discipline, you can become a proficient Forex trader.